The IMF predicts that if the chosen path with zero emissions is followed, the growing demand for the four metals that are key to the energy transition will increase the cost of their production sixfold to $12.9 trillion over two decades - possibly equaling the estimated cost of oil production over this period.

We are talking about copper - its price can rise to 12 thousand US dollars per ton, nickel — its price will rise to 45 thousand US dollars per ton, cobalt - the price will rise to 250 thousand US dollars per ton and lithium - its price can rise to 16 thousand US dollars per ton.

Kazakhstan, which has extensive copper reserves, benefits from such a scenario, but we continue to be pressured by the possibility of introducing a separate carbon tax due to the high emissions of our economy.

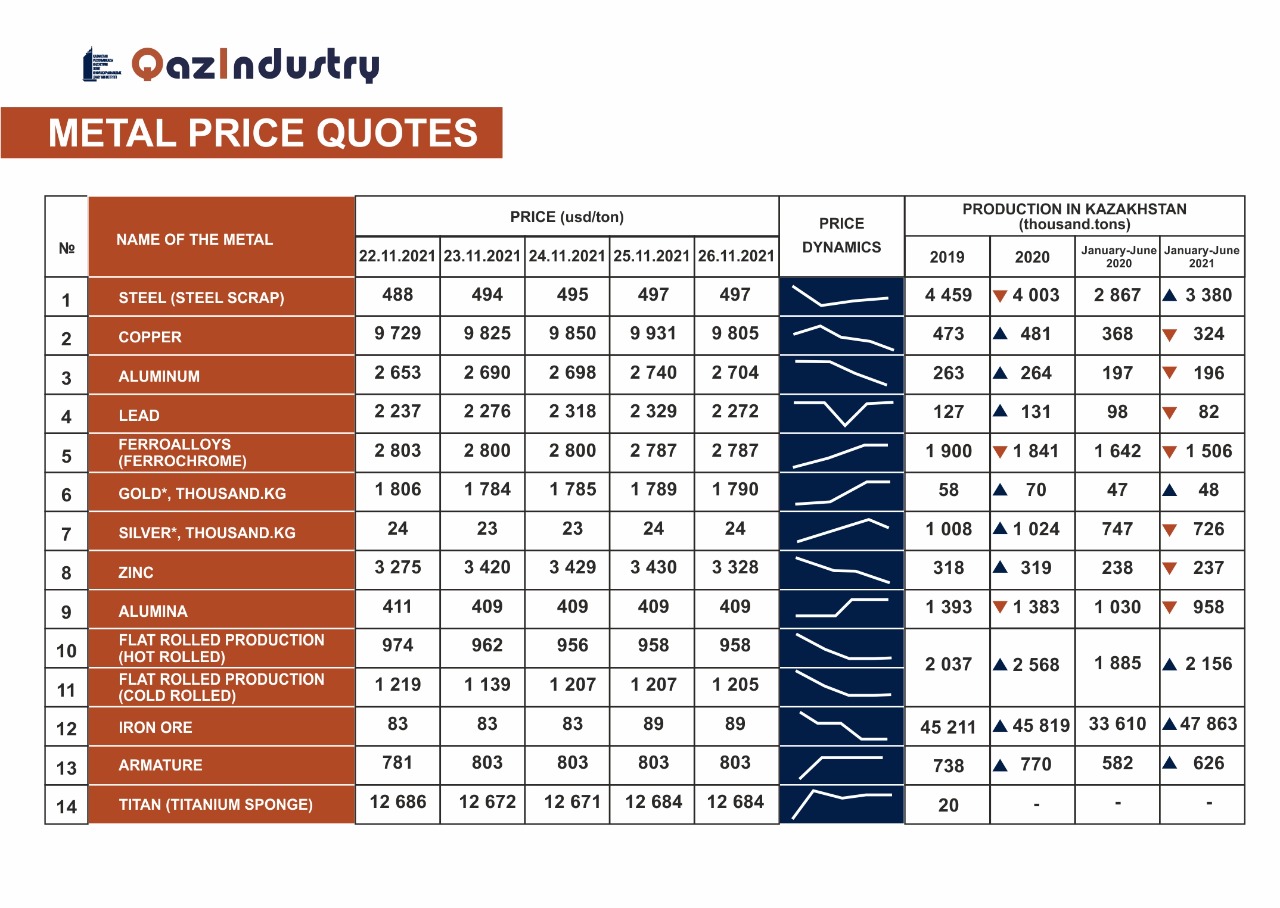

Last week, copper and other metals fell by 1.5-2%, due to the slowdown in China and a new strain of the virus. Metals feel a little better than oil. In the case of metals, stocks play a stabilizing role. They are extremely low, so they support quotes even in such a difficult time. Aluminum is doing a little worse than the rest, due to the renewed fall in coal prices in China. Immediately minus 10% after six days of growth.