Kazcentrelectroprovod

Cable and wire products represent a significant part of the electrical engineering sector and have a wide range of applications. It is used in energy, communications, mechanical engineering, housing and communal services and transport, construction, metallurgy and other industries.

The state of the sector and prospects for the development of cable and wire products were discussed at the Mechanical Engineering Development Directorate of the QazIndustry KCIE.

One of the oldest and largest manufacturers of cable and wire products in Kazakhstan are Kazcentrelectroprovod LLP, founded in 1993, and Kazenergokabel JSC, opened in 1994.

Kazcentrelectroprovod is the leading manufacturer of optical cable in the country, with a production capacity of 72 thousand km of optical cable per year, 42 thousand km of LAN cable and 200 thousand units of optical cords.

Kazenergokabel is distinguished by a wide range of products, producing more than 17 thousand items and brand sizes. The production capacity of cables and wires is 80 thousand km per year. The company also produces aluminum wire rod with a capacity of about 15 thousand tons annually.

As of February 1, 2024, 47 companies producing electrical wires and cables, including fiber optics, were registered in Kazakhstan. In addition to the above, these are Taldykorgan Cable Plant LLP, Elektrokomplekt-1, Kazelectromash, Kazenergo-1, K.AZ TEL, Trans Cable LLP, Aknur Kabel, OK Oral Cable, KMK Investment (Evrazkabel) and others.

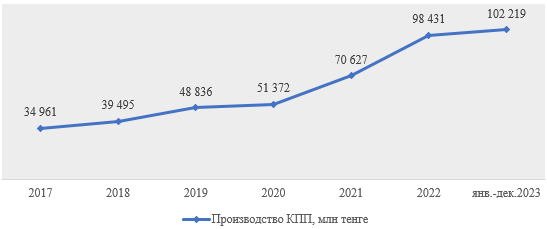

The sector is showing positive dynamics. Thus, over the past seven years, production volume has increased 2.9 times, exceeding 102.2 billion tenge (for January-December 2023). The CAGR of production for the period under review was 39.9%.

Dynamics of production volumes of cable and wire products

for 2017-2023, million tenge

Source: BNS ASPiR RK.

In 2023, production in the country amounted to 1,534 thousand km of cables and wires, which is 42.3% higher than the previous year.

The growth of production indicators over a seven-year period was influenced by the launch of a number of projects. In particular, the renewal of the equipment fleet of Kazelectromash LLP for the production of enameled wires with a capacity of 100.8 tons, the opening of the production of copper cable for civil construction (OK Oral Cable LLP) with a capacity of more than 2000 tons of copper, the production of cable and wire products with cross-linked insulation polyethylene for voltage up to 220 kV (KMK Investment LLP) with a capacity of 24 thousand tons.

In addition, government support measures in the form of subsidizing part of the interest rate on loans/financial leasing agreements (to replenish working capital, purchase additional equipment for modernizing production, implementing projects), providing innovative grants for technological development, promoting exports, assistance in reimbursement of costs for certification, delivery of goods for export, registration of trademarks.

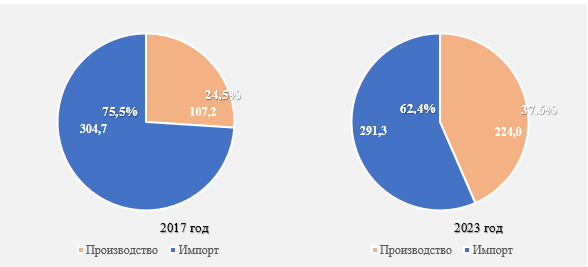

As a result of such support, local manufacturers now occupy up to 40% of the domestic market for cable and wire products (market capacity at the end of 2023 is $467 million), and the volume of production in dollar equivalent is only 23% less than the volume of imports. For comparison: the share of OTP in the Kazakhstan market in 2017 did not exceed 24.5%.

Market of the Republic of Kazakhstan for cable and wire products for 2017 and 2023, million US dollars

Source: BNS ASPiR RK, State Revenue Committee of the Ministry of Finance of the Republic of Kazakhstan, TradeMap.

The key suppliers of cables and wires to Kazakhstan are Russia and China. At the end of 2023, their share in imports was 45.7% and 19.9%, respectively. Mainly imported into Kazakhstan are electrical conductors with a voltage of no more than 80 watts (46.9%), conductors with a voltage of more than 1000 watts (19.6%), conductors with a voltage of no more than 1000 watts, equipped with connecting devices (16.3%) .

About 22% of cable and wire products produced are exported (according to official statistics, in 2023 the export volume amounted to $48.3 million). The main markets are Russia (55.4%), Kyrgyzstan (16.1%) and Germany (15.9%). 50% of exports are electrical conductors with a voltage of no more than 80 watts, 23% are fiber optic cables.

In the near future, in the absence of external “shocks” (sharp fluctuations in the national currency exchange rate, disruption of channels and delays in the supply of materials and equipment, changes in the political and economic environment in the region), the positive growth rate of cable and wire production is expected to continue. Such expectations are based on taking into account the dynamics of production in recent years, the development of new types of products, and the implementation of investment projects.

For example, in 2023, the startup company Beta Izol developed a new type of cable - for photovoltaic systems with radiation cross-linked insulation - and entered into a contract with an Uzbek company to supply cables for the construction of solar power plants. The LED Solution plant was launched to produce cable and LED products with a capacity of up to

8500 km of cable per year.

In 2025, it is planned to launch a plant for the production of cables and transformers, Aktu Energomash LLP, with a capacity of five thousand tons of cable.

The demand for cable and wire products continues unabated. The products are in demand among large enterprises in the mining and oil and gas industries (NC KazMunayGas JSC, Kazakhmys Corporation LLP, Kazzinc, ENRC Kazakhstan), subsidiaries of Samruk-Kazyna JSC, and telecommunications companies.

Due to intensive construction, there is a need for VVGNG power cables. Don’t forget about export opportunities: imports of cable and wire products by countries of the macroregion (Afghanistan, Armenia, Azerbaijan, Belarus, Iran, Kyrgyzstan, Moldova, Mongolia, Russian Federation, Tajikistan, Turkmenistan, Ukraine, Uzbekistan) in 2022 exceeded

$1.7 billion (according to TradeMap).

In order to promote the development of production of cable and wire products, it is necessary to strengthen control over product compliance with GOST requirements in order to avoid an influx of counterfeit cables; introduce exceptions from the national regime in order to expand distribution channels; facilitate the provision of raw materials and materials; facilitate entry into export markets through pre-export financing and reimbursement of product transportation costs.