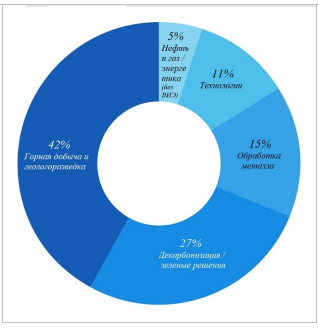

Based on a survey of mining and metallurgical complex (MMC) managers, Ernst&Young has compiled a report entitled "Top-10 mining and metals risks and opportunities in 2024". The report summarizes the main risks and opportunities that face the mining and metals industry globally, which are grouped into different categories. (Figure 1) illustrates the dynamics of ratings for these groups from 2023-2024. Based on each group, global trends in mining and metallurgical complex development are examined.

Picture 1

Source : EY mining and metals business risks and opportunities survey data 2024.

1 . Environmental, Social and Corporate Governance (ESG)

The mining and metals industry has identified compliance with ESG criteria and standards as its most important issue for the third straight year.

Trends

1. Approximately half of the mining and metals industry companies are looking for innovative solutions for tailings storage facilities and waste management. As a result, over 200 billion tons of tailings are managed today, and this number will grow by 40-50 billion tons in the next five years. Rio Tinto, Teck Resources, and UBC have begun a joint project to identify microbes that bind to minerals and extract tailings elements without using chemicals. The binding of microbes to selenium, for instance, prevents toxic substances from mining wastes from entering the water. Microbes can also be used to extract copper from slag. Agroforestry and wetland fisheries were used by Gold Fields to restore the ecosystem around the Damang mine tailings pond in Ghana.

2. Water resource management is one of the main ESG factors for half of the companies in the MMC. The issue is also a priority for many governments. The Chilean government mandates that continental water will make up no more than 10% of the total amount of water used in copper production by 2050. Similar restrictions are likely to be adopted by other drought-stricken regions. Several mining and metals companies strive to ensure transparency in water resource management. The first mining company to publish water usage data on its website was Rio Tinto.

3. Mitigating mine closure is a topic mining and metals companies are focusing on as they work to repurpose sites, establish secondary businesses, and make local communities more valuable. As part of the Leadership in Sustainable Mine Closure program, EY works with Rio Tinto, Curtin and British Columbia universities to demonstrate the benefits of successful mine closures. Pilot projects are being implemented to account for natural capital in the mining and metals sector by utilizing the example of the closed and rehabilitated BHP mineral sands mine in South Western Australia.

2. Capital

Energy transition (ET) has resulted in a critical deficit of raw materials such as copper, lithium, and nickel. Mining and metals industries require large investments to increase their production of these metals.

Trends

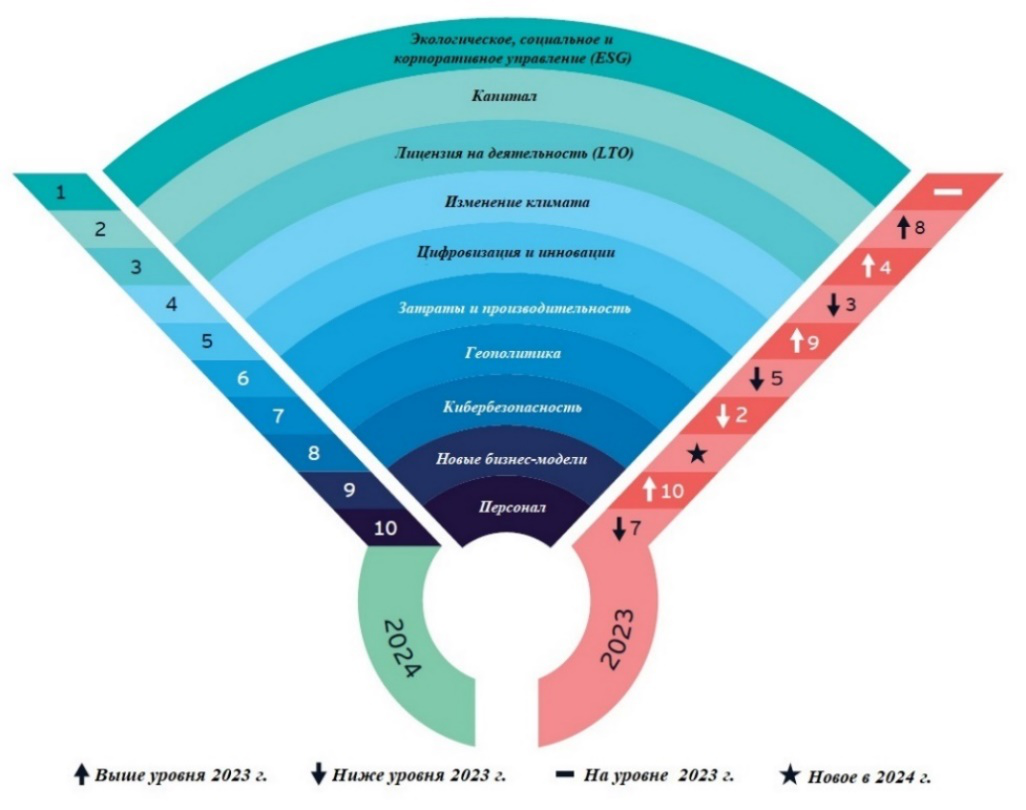

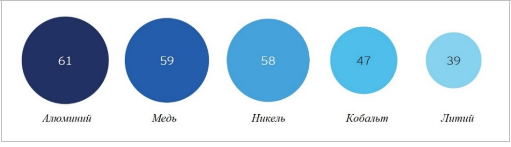

1. Investment in nickel and lithium increased significantly in January-July 2023 (Figure 2). In Australia and Canada, large nickel producers raised $ 2.76 billion through IPOs, while small lithium mining companies raised $ 560 million.

Figure 2. Raising capital by sector/product for January - July 2023 , change in %

Source : EY analysis of refinitiv data.

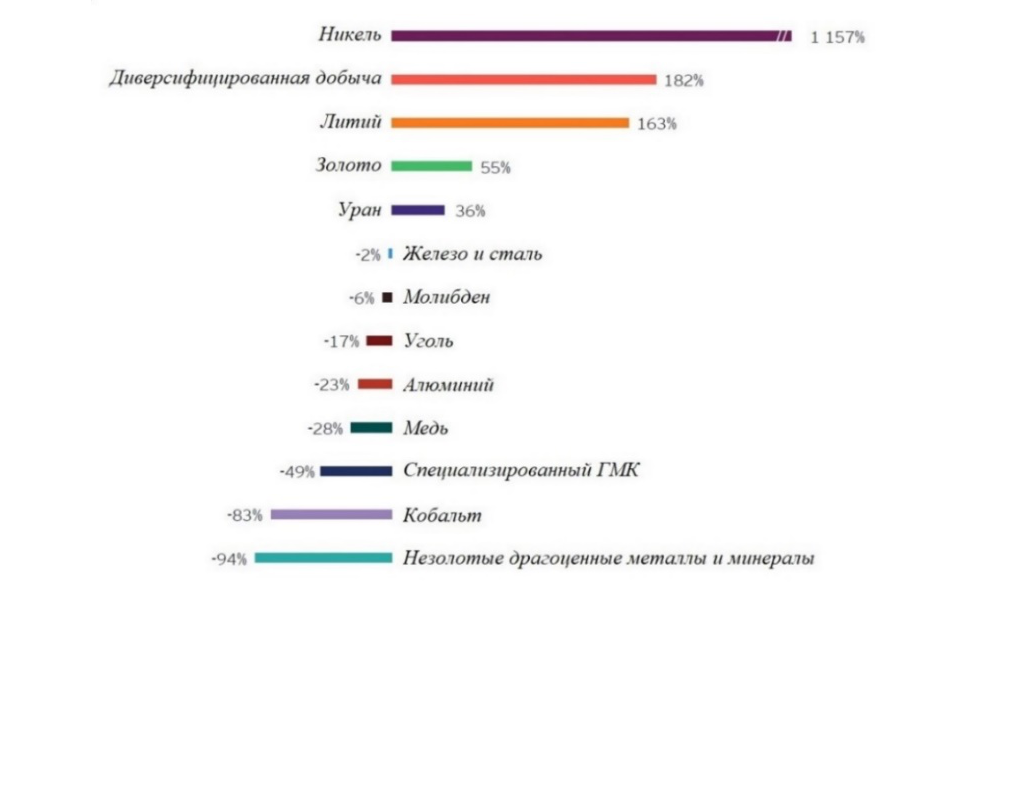

Currently, lithium projects are being developed and evaluated throughout North America, with the majority of projects in South America (Figure 3).

Figure 3. Lithium projects by country/region and stage of development, number of projects/mines

Source : EY analysis of S&P Capital IQ pro data.

2. Based on initial spending on projects costing more than $1 billion for 2020-2023, large investments are anticipated for copper, gold, lithium, and nickel production over the next decade (Figure 4). More than three quarters of these projects have reached the assessment or feasibility stage, but have not yet been approved for investment. A growing number of countries are spending on exploration, particularly the United States, Canada, and Australia. EP focuses on minerals and metals. In 2022, more than half of all exploration capital will be invested in the United States, Canada, and Australia, which have low-risk environments. The search for new gold deposits consumes half of the annual geological exploration budget.

Figure 4. Initial investments in projects worth more than $ 1 billion by five types of raw materials for January 2020 - August 2023 , $ billion

Source : EY analysis of S&P global capital IQ pro data.

3. In 2023, assets in the copper, gold, steel, and lithium sectors are expected to be consolidated. BHP has acquired gold and copper producer OZ Minerals, while Glencore has acquired Argentina's MARA copper project for the remaining 56%. Yamana Gold has been acquired by Pan American Silver as part of the gold mining consolidation. Australian Newcrest Mining will be acquired by American gold miner Newmont. Cleveland-Cliffs steel company approached USSteel about acquiring its assets. Allkem and Livent have announced a merger to create the world's largest lithium producer.

4. Mining and metals industry investments are driven by consumers' need for a sustainable supply in times of a shortage of critical raw materials. Therefore, General Motors invested $650 million in Lithium Americas, and Tesla is building a lithium plant in Texas and has agreements with mining companies and Chinese lithium hydroxide producers.

3. License and Permits to Operate ( LTO )

GlobeScan's 2021 report shows that the mining and metals industry in 31 countries of the world ranked last in terms of public trust. Half of people believe mining and metals companies aren't doing enough to resolve social problems, according to the 2023 Edelman Trust Barometer. Historically, the MMC has produced negative results, including environmental damage, as well as an inability to prepare for the progressive existence of local communities after its business in the area is closed. State governments also require mining and metallurgical companies to comply with a number of formal and informal obligations within the framework of LTO. Mining and metals companies must be accountable to the public and maintain long-term trust to maintain LTO and grow their business.

1. The University of Queensland's Sustainable Minerals Institute found that over half of the 5,000 mining and metals industry projects are implemented near indigenous populations' places of residence, leading to the need to collaborate with local communities for trust and approval of MMC projects. Therefore, investors should include local communities as stakeholders in their projects and consider their preferences. As a result, employees are more engaged and fewer walkouts occur, while communities see the value of these companies' contributions to local education, infrastructure, and health care. As an example, SOUTH is developing environmental management approaches with Illawarra Aboriginal Land Council and University of Wollongong in Australia. The traditional knowledge and experience of Indigenous people with nature makes them valuable partners in making such decisions. International Council on Metallurgical Metals (ICMM), the OECD, and Copper Mark (the International Copper Association's industry standard) have increased their expectations for community involvement and development.

2. Business transparency requirements are imposed by local communities, investors, and regulators on mining and metals companies. Today, MMC is saddled with unprecedented ESG responsibilities. By voluntary disclosure of information, businesses demonstrate their responsibility, including new standards IFRS S1 General Requirements for Financial Disclosures Relating to Sustainable Development and IFRS S2 Climate Change Disclosures, which will become effective from 1 January 2024 .

4. Climate change

According to the World Economic Forum's Global Risks Report for 2023, climate change and climate events will be the world's biggest threats in the coming decade (Figure 5). Mining and metals companies will have a resource base for reducing such risks through ES and reducing greenhouse gas emissions (GHG).

Figure 5. Long-term and short-term global risks ranked by severity

Source : World Economic Forum.

Trends

1. Mining and metallurgical complexes and companies are increasingly impacted by climate change phenomena that require systematic and large-scale planning. According to the World Gold Council's report "Gold and Climate Change: Adaptation and Resilience", there are a number of adaptation strategies to combat climate impact, including those that have a negative impact on the supply chain. As a result of wildfires in 2023 in Canada, many miners were forced to suspend operations and evacuate employees, forcing affected companies to adjust their business processes accordingly.

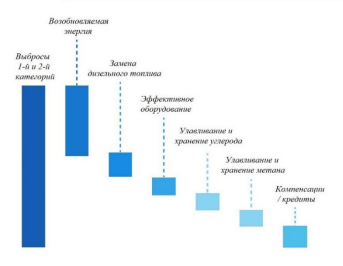

2. Efforts to achieve zero GHG emissions, including innovation, are influenced by the high costs, long timeframes and uncertainty of decarbonization projects. Companies in the mining and metals industry admit they are having difficulty achieving interim targets for zero GHG emissions. Investment in renewable energy sources (RES) is stimulated by government support in many regions. As an example, Anglo American's electricity was sourced from renewable resources in 2022, reducing its greenhouse gas emissions. Renewable energy plays an important role in Scope 2 decarbonization, but it is hard for companies to obtain green energy in large quantities (Figure 6). Alternatives to expensive electrification of transport diesel fuels are being considered by MMC companies, including batteries, hydrogen, and biofuels. According to Fortescue Metals Group, it will invest $ 6.2 billion in renewable energy sources, green mining transport, and locomotives by 2030. Carbon and methane capture and storage are difficult and require innovation.

Figure 6. Emission reduction pathways for categories 1 and 2 of CO2

Source : EY Global Mining & Metals “Top-10 business risks and opportunities for mining and metals in 2024.”

The mining and metals sector has focused on research and development in the field of decarbonization, for which they are developing innovative ecosystems. The Pathways to Decarbonize Steel competition has been launched by Anglo American to encourage start-ups and businesses to develop low-carbon steel technologies. As part of its partnership with the European Institute of Innovation and Technology of the European Union, the company aims to establish platforms for collaboration between researchers and businesses. ICMM's Innovation for Cleaner, Safer Vehicles initiative is aimed at developing GHG-free vehicles for the mining industry by 2040 in collaboration with OEMs. Earlier this year, Nickel Creek Platinum and the University of British Columbia's CarbMinLab reported that samples from the Wellgreen deposit contain magnesium-rich minerals (such as brucite) that can react quickly with CO2 in the air and absorb it.

3. Global decarbonization policies led to the sale and closure of coal assets. The coal assets of diversified mining and metals companies are being sold or are being phased out. Therefore, BHP intends to close the Mt Arthur coal mine. In terms of shareholder opposition, 30% of Glencore's shareholders opposed the purchase of Teck's coal business. HSBC plans to stop financing coal enterprises in EU and OECD countries by 2030, and Standard Chartered will stop providing financial services to companies that receive 100% of their revenues from thermal coal by 2040.

4. Increasing disclosure requirements for GHG emissions categories 1, 2, and 3 are also a result of the global "green" agenda. The International Sustainability Standards Board (ISSB) agreed in 2023 to require companies to report their GHG emissions. Securities and Exchange Commission (SEC) plans to require public companies to disclose information on GHG emissions. In cooperation with the Scientific justified goals (SBTi), ICMM has developed a system for accounting for GHG emissions in category 3 in MMC using clear and transparent definitions.

Companies need to report the impact of climate change on sales, managing climate risks, and testing and adjusting strategies under different climate change scenarios, according to the Task Force on Climate-Related Financial Disclosures (TCFD).

5. Digital technologies and innovations

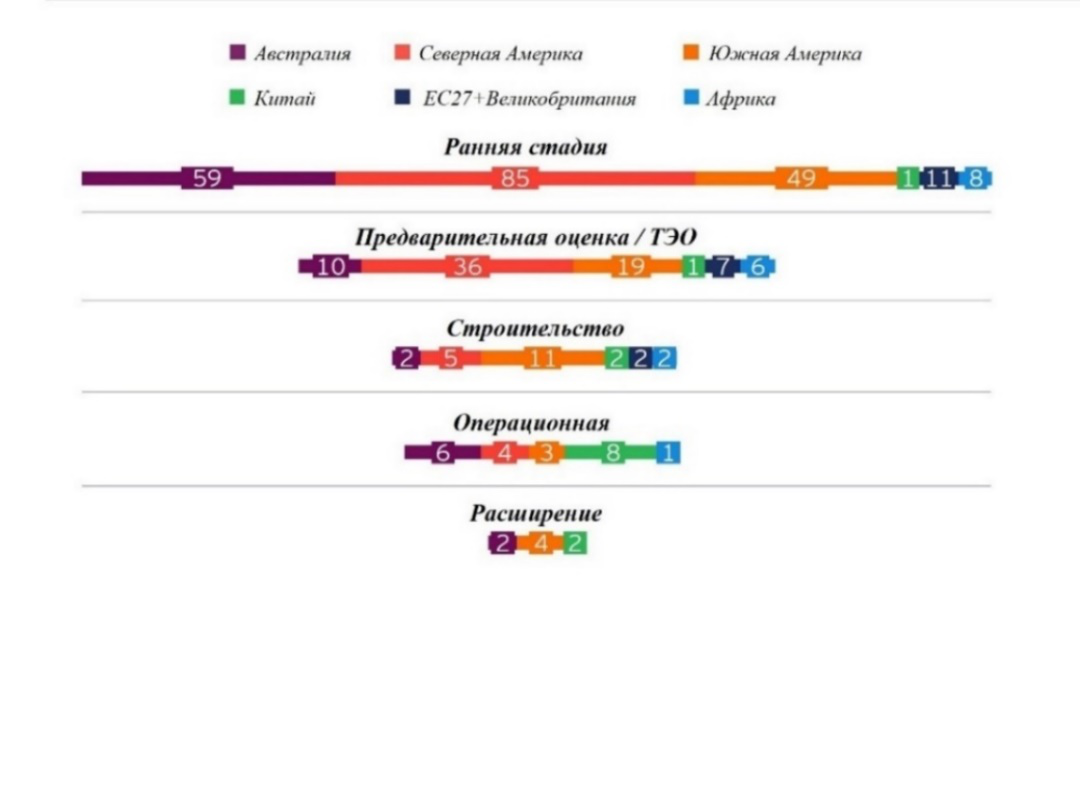

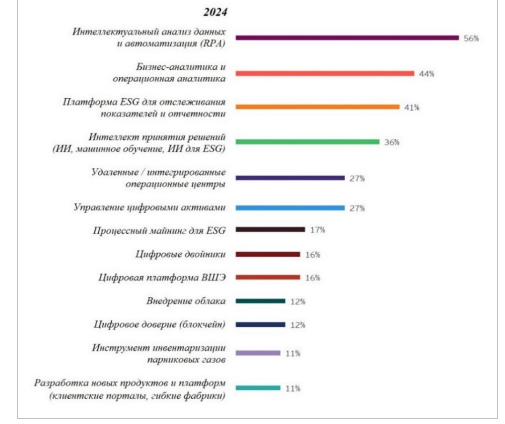

Survey of mining and metals industry managers suggest that the industry needs digital solutions to reduce costs, increase productivity, decarbonize, and achieve environmental goals (Figure 11).

Figure 11. Priorities for digitalization versus MMC for two years (respondents could select more than one option)

Source : EY mining & metals Business risks and opportunities survey data 2024.

Trends

1. Considering the potential of Generative artificial intelligence ( GenAI) was driven by the need to improve the quality of large data sets offered by MMC. GenAI offers MMCs promising opportunities (Table 1), but also creates additional operational management challenges.

Table 1. GenAI capabilities for MMC

• Extract contract data for supplier management. • Expedite the preparation and review of requests for proposals. • Context-based search of legal documents can increase capacity in mining and metallurgy . • Multilingual support and transparency. • Assistance in standardizing procedures for concluding and executing supply contracts. |

• Automate the creation of context-sensitive security and risk management strategies tailored to specific site conditions. • Assist with technical maintenance by compiling summaries and locating internal technical documentation. • Accelerate capital expenditure planning through human-machine collaboration. |

• Perform an initial media scan to assess the supplier's labor practices. • Assistance in screening for greenwashing . • Facilitate identification of issues among stakeholders and sentiment analysis based on public consultations . |

• Optimization of new projects by preparing applications and planning scenarios. • Creating risk profiles for climate extremes and natural disasters (resilience) . |

• Combine anonymous reports and suggestions about workplace safety incidents. • Assist in the creation and delivery of site specific educational materials. • Identify violations of procedures using interview protocols and other logs. |

• Assist in developing and reviewing strategy to ensure consistency across geographies and languages. • Automated monitoring of compliance with business processes. • Monitor updates to regulations and guidelines to identify existing practices that require revision. |

Source : EY Global Mining & Metals “Top 10 business risks and opportunities for mining and metals in 2024.”

2. Digital twins (DTs) are gaining popularity because they can collect more data remotely in real time and better understand all the objects under control. Rio Tinto creates virtual models of mines at the Gudai-Darri mine. As a result, solutions are tested in the field before implementation, increasing productivity and safety while maximizing return on investment.

The ESG purposes help MMC improve data collection, storage, and analysis from operating system, corporate, and third party sources, enabling you to develop and implement sustainable development roadmaps. The EY-Parthenon 2022 Digital Investment Index found that 26% of mining executives believed digital investments had a positive impact on addressing ESG issues, while 23% said sustainable development is the primary operational goal for digital investments over the next two years.

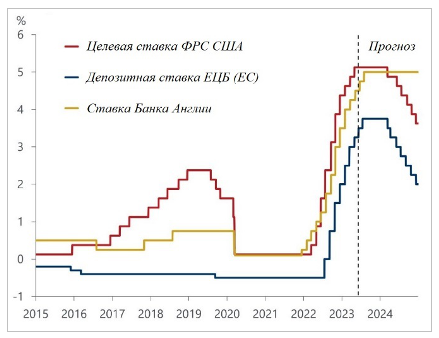

According to estimates by the International Monetary Fund ( IMF ) , Inflationary pressure in the world is slowly weakening: if in 2022 global inflation was the highest since the mid-1990s - 8.7% , then in 2023 it is expected to be 6.9%, and in 2024 - 5.8%. According to Oxford Economics, interest rates in leading economies are also at their peak and will decline (Figure 8). Nonetheless, these processes will have a slow and gradual impact on mining and metals.

Figure 8. By 2024, interest rates are expected to be satisfactory in developed countries

Source : Oxford Economics / Haver Analytics.

Trends

1. Magnification expenses in the mining and metals industry, which is expressed in an increase in labor and energy costs exceeding the level of inflation and refinancing rates in developed countries (Figure 9). Labor costs are on the rise due to skill shortages. For example, the mining and metals industry in Australia is concerned about legislation that requires employers to pay the same wage rate to contract and full-time employees, which will increase labor costs. As a result of the war between Russia and Ukraine, energy prices continue to rise.

(a) Labor costs (b) Electricity costs

Source: EY analysis of S&P global capital IQ pro data.

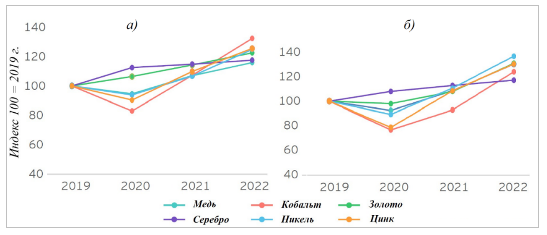

2. Despite rising commodity prices, the mining and metals industry has experienced declining profitability (Figure 10), which is due to higher operating costs, taxes, capital costs, and productivity issues. Production royalty rates have been raised in some countries. Thus, in 2024, Chile will increase its production royalties to 14% and introduce ad valorem customs duties.

- 1% of sales, which forces BHP to reconsider its Chilean investment plan worth $10 billion, and other mining and metals companies doubt its investments worth $70 billion. The cost of capital increases when bank rates are high. The average loss on the 132 development projects costing over $1 billion was $500 million. Cost overruns were common in one out of five projects costing more than $1 billion. Lack of experience, a lack of a systematic, comprehensive approach, and a prioritizing of environmental sustainability over productivity are the main causes of productivity problems in mining and metals.

Figure 10. The price of raw materials in the first half of 2023 compared with the first half of 2019, change in percentage

Source: EY analysis of S&P capital IQ pro and refinitiv eikon data.

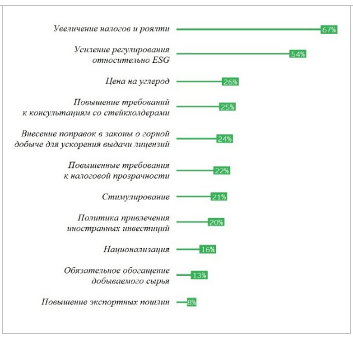

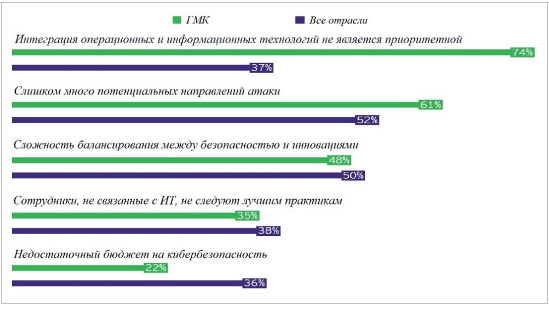

Conflicts between China and the West, wars in Ukraine, resource nationalism, global decarbonization, the weakening of international cooperation institutions, tensions between the West and China, wars in Ukraine, resource nationalism. As mining and metallurgical companies compete for strategic raw materials, geopolitical risks and opportunities are determined by the expectations of the government (Figure 11).).

Figure 11. Respondents could choose more than one option regarding their expectations regarding government action over the next year.

Source: EY mining and metals business risks and opportunities survey data 2024.

Trends

1. Increasing state involvement in the mining and metals industry until nationalization, increasing taxes and royalties, restraining the mining and metals industry from using low-process raw materials in favor of processing them, and introducing a national carbon tax will be the manifestation of “carbon” nationalism.) .

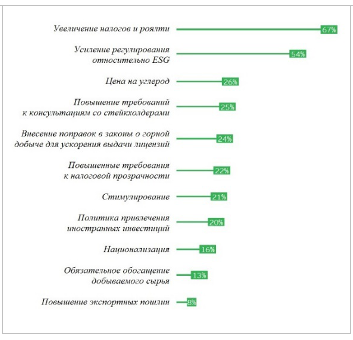

Figure 12. A number of government actions have been taken regarding the mining and metals industry since December 2020

Source: EY mining and metals business risks and opportunities survey data 2024.

Consequently, Mexico nationalized its lithium assets, and other countries are considering this issue. Increasingly, countries are restricting exports of unprocessed raw materials and building their own fossil fuel processing plants. As a result of nickel export ban discussions, the Philippines has increased nickel processing revenues, and Indonesia has increased nickel export revenues.

The EU's implementation of the Cross-Border Carbon Management Mechanism (CBAM) is expected to encourage other countries to introduce similar restrictions for the sake of fairness for domestic producers and limited imports of embedded carbon dioxide emissions. Steel, iron ore, aluminum and some refined products will be covered by the CBAM transition period that began on 1 October 2023. Tax rates for some companies are an issue, but developing countries also have concerns about their competitiveness. Under the International Trade Act, the CBAM may still be challenged. India, for instance, has openly opposed it. Due to a difference in carbon pricing between India and Europe, the CBAM mechanism was considered "unfair.". The Indian government will introduce its own carbon tax if CBAM is not abolished by 2026.

Consequently, metal and mining companies must build strong relationships with their governments. As an example, Dundee Precious Metals proactively signed an investment protection agreement with the Ecuadorian government in August 2023 to ensure regulatory and tax stability, as well as continued access to tax incentives, in the wake of calls for a mining ban in the Chocó region Andino .

In January 2023, the EY CEO Outlook Pulse survey revealed that mining and energy CEOs changed their strategies in response to geopolitical challenges. In addition, 41% have reconfigured their supply chains and 39% are exiting certain markets while 32% have suspended planned investments. Increasingly, companies are creating positions dedicated to managing geopolitical risks.

2. Competition for MMC resources and decarbonization is increasing due to government environmental incentives, such as the US Inflation Reduction Act (IRA) and the EU Critical Raw Materials Act (CRM Act), as raw material demand increases faster than clean energy supply, with developed economies competing for developing countries' strategic resources. Since August 2022, the American Clean Power Association (ACP) reports that the private sector has invested $270 billion in U.S. clean energy from utilities - a total of eight years of clean energy investment from 2015-2022. Demand for mining and metallurgy products will be sharply increased as a result of such investments in green technologies and energy. Mining and metals sector obstacles related to environmental permitting and licensing are causing concern that the gap between demand and supply of critical raw materials will widen in the medium term. Through incentives and grants, especially for battery metals, the EU and US could challenge China's dominance in Africa and other developing regions.

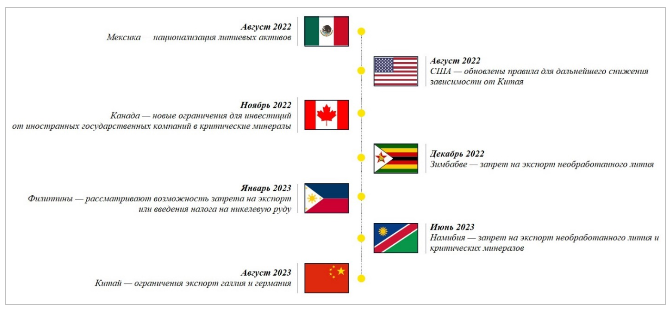

8. Cybersecurity

The issue of cybersecurity returned to the ranking for the first time since 2020 as cybercriminals are increasingly launching MMC attacks. According to the World Economic Forum, cyber threats require immediate attention. The Global Cybersecurity Leadership Insights Study conducted by EY in 2023 revealed that there are problems in the mining and metals industry's approach to cybersecurity.

Figure 13. Cybersecurity's internal challenges

Source: EY 2023 Global cybersecurity leadership insights study.

Trends

1. As MMC companies implement more IT systems to manage and control their physical systems and processes, the potential for cyber attacks grows against the background of low cyber culture. Meanwhile, operations operators and OEM suppliers block security measures for fear that they will lead to downtime and reduce productivity. The "human factor" plays a significant role in the cybersecurity of mining and metallurgical plants.

2. The US Securities and Exchange Commission (SEC) adopted new cybersecurity risk management rules in July 2023, requiring public companies to disclose information about cybersecurity incidents and describe their cyber risk management processes. Government regulation of cybersecurity issues began then. Many large public companies involved in mining and metals are likely to be affected by these requirements. Cybersecurity has become a key issue in the mining and metallurgical complex due to the sheer scale of the threat and emergence of new requirements.

9 . New business models

According to an EY analysis, most mining and metals companies make investments primarily in traditional areas such as exploration, production, and processing of minerals so that their profits remain stable, as well as their ability to invest in new technologies, sustainable development, and business models (Figure 14).

Figure 14. Mining and metals investments by the 12 largest companies between 2018 and 2022

Source: EY strategy edge, march 2023.

Trends

1. MMC companies are increasing the pace of implementation of new business models both vertically and horizontally along the entire value chain . Mining and metals are attracting investments in advanced processing technologies as developing nations look for alternatives to China as part of the vertical transformation of businesses. Nickel ore is processed using the high pressure acid leaching (HPAL) method in Indonesia. Around the world, lithium companies combine ore mining with processing and battery manufacturing. As technology producers look to provide themselves with raw materials, and companies receive capital from them to build new mines, cooperation in value chains is expanding. Businesses that are horizontally changing their business models develop adjacent processes and areas, such as infrastructure, energy, and operational technology, to ensure sustainability and reduce their risks. As an example, Anglo American and EDF Renewables created Envusa Energy, which will develop a renewable energy system in South Africa. By 2030, Envusa Energy is expected to generate between 3 and 5 GW of green energy, increasing the value of the electricity grid in South Africa. Additionally, mining and metals companies invest in startups in the fields of energy storage, batteries, and hydrogen. As an example, Fortescue recently announced the acquisition of a hydrogen hub in Phoenix, Arizona, and plans to build a hydrogen production plant in Brazil.

2. The global green agenda is having a greater impact on business model choices, including its role in decarbonization and circular economies. Low-carbon metal production technologies are being introduced by MMC companies. As an example, Norsk Hydro's REDUXA technology produces aluminum products with less than 4 kg CO2/kg aluminum, compared to 16.7 kg CO2/kg aluminum industry average. A technology developed by Vale allows ore to be enriched to 67% iron at its Carajas complex, and the company is exploring carbon-free steel production.

BHP and engineering firm Hatch are installing a pilot electric smelting furnace (ESF) capable of producing steel from iron ore using green electricity and hydrogen to directly reduce iron (without coke). The MMC has made significant progress in promoting the circular economy. More and more mining and metals companies are investing in recycling. Thus, Glencore is developing the processing of batteries and base metals - copper, zinc, nickel and lead. Recycling will be an important source of metals in the future (Figure 15).

Figure 15. Share of total demand for metals in 2050 that can be satisfied through recycling (forecast), in %

Source: IEA 2022 and world bank 2020.

10. Staff

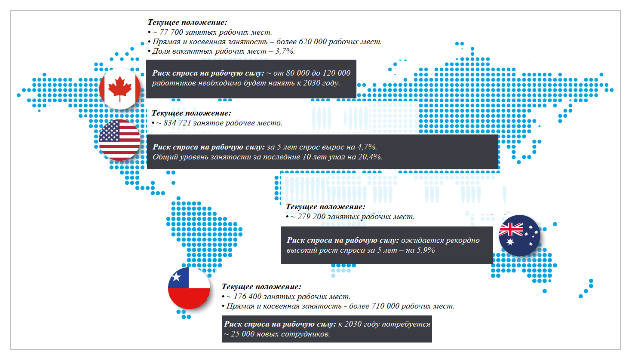

The mining industry, in particular, continues to face a shortage of qualified personnel (Figure 16) .

Figure 16. Mining industry shortages of qualified personnel in key markets

Source: Deloitte Tracking the trends 202 3. The indispensable role of mining and metals

The competitive labor market and negative perceptions of the industry tend to discourage young workers from joining companies whose values align with theirs.

As a result, current personnel are aging, and automation has the potential to improve working conditions. Trade unions representing workers at mining and metals companies call for increased business reporting to identify trends and prevent serious damage to health workers in the future. According to the Australian Resources and Energy Employers Association, the annual turnover rate in medium-sized mining and metals companies is 30-35 %. Thus, high staff turnover and a low level of qualification negatively impacts productivity and innovation.

Trend

The shortage of qualified personnel is forcing mining and metals companies to rethink recruitment strategies, balancing the need for new specialists with advanced training and retraining of existing employees. Companies strive to achieve this by upskilling internal employees, hiring international workers despite logistics and immigration costs, and attending university career fairs and programs to attract young professionals. A variety of approaches are being considered to generate interest in the sector, for example community initiatives and children's tours of mines. As an example, Minecraft is collaborating with the Minerals Council of Australia, the University of Queensland, and Mining Education Australia to include mining in school curricula through video games.

Conclusion . Kazakhstan's mining and metals industry is one of the most export-oriented industries. As a result, it is heavily integrated into global processes. Accordingly, the global trends discussed in the article in the mining and metals sector over a short period may, to some extent or another, affect our country's mining and metals sector.